What’s New in Robotics? 19.01.2024

Posted on Jan 19, 2024 9:44 AM. 8 min read time

News briefs for the week take a look at CES2024 with its fewer robots but much more AI (artificial intelligence), Doosan Robotics at CES getting an early entry into the AI-infused cobot market for 2024, cobots for 2024 pursuing the "final solution" in the hunt for perfect palletizing in a projected $2.2 billion global market, ABB Robotics cutting in two new directions with its robots (logistics and home building), and a small North Carolina entrepreneur stick-building complete homes with factory robots.

CES2024: Few cobots, lots of AI

Strangely, the Wall Street Journal sent zero reporters to CES2024, with one WSJ journalist remarking that CES has really become a super-size auto show with tons of gadgets; and “its influence in tech has been waning.” Seems a valid observation. Throw in multiple showrooms with slick autonomous farm robots and giant concept drones for future urban travel, and you’ve got CES2024 in a nutshell.

One thing that nearly every one of the 4,000-plus exhibitor booths had in common was some sort of artificial intelligence (AI) married to their products. With CES struggling since COVID to return to those heady days of wall-to-wall humanity (circa 2018), AI served well as a spark of interest to drive attendance, which several sources tabbed as in the 100K range (record 180k in 2018).

One thing that nearly every one of the 4,000-plus exhibitor booths had in common was some sort of artificial intelligence (AI) married to their products. With CES struggling since COVID to return to those heady days of wall-to-wall humanity (circa 2018), AI served well as a spark of interest to drive attendance, which several sources tabbed as in the 100K range (record 180k in 2018).

Just to make sure that AI got enough attention as this year’s headliner, CES 2024 featured more than 30 panel discussions on AI, GenAI, machine learning (ML), and their impact on various business segments.

One AI aspect for sure was that CES2024, held January 9-12, in Las Vegas, was the year’s kickoff and vanguard of many tradeshows to come that will be stockpiled to the rafters with AI-enabled industrial robots, cobots, and automation gear. As for CES2024, there was little in the way of industrial anything, except for cobot maker, Korea’s Doosan Robotics, that was there in force.

Since its wildly successful IPO last October, Doosan has been ramping up public exposure and its PR agenda to the max. Getting a first-encounter jump on the AI-enabled cobot scene, Doosan rolled into CES2024 with a full-blown, new-product showcase in its 8,000-square-foot booth (average home in the U.S. is 2,300 square feet). Doosan also made room for AI-controlled tractors from its Bobcat subsidiary.

Doosan took advantage of CES2024 to debut what it calls Dart-Suite, a cobot ecosystem that the company claims is “redefining the robot experience.”

Doosan’s new line of AI-enabled cobots are designed to take on the more labor-intensive tasks across industries including manufacturing, logistics, food and beverage, architecture, filmmaking, service sectors, and medical environments.

For one, Doosan unveiled its Otto Matic, a depalletizing and palletizing solution designed to handle unstructured and random-sized boxes, which was developed in partnership with computer vision technology provider Korea-based AiV and San Jose-based TDK Qeexo.

Going forward, 2024 is shaping up to be maybe the final assault on depalletizing and palletizing solutions; Doosan and others are already claiming victory.

Cobots: In hot pursuit of pallets

Ever since it was patented in 1925 and popularized in the 1930s, how best and how quickly to load and unload pallets has been pursued by workers and machines without much improvement, until the dawn of the robot, and now, its little brother, the cobot.

Palletizing and depalletizing with a robot is done virtually in isolation from people. If not, injuries to workers in close proximity to the robot and pallet can easily occur. Robots satisfy the speed part of the equation but still are not the ideal.

Cobots, now with bigger payload capacities (between 20kg and 50kg) and longer reaches, are the tools of choice when palletizing alongside workers or with mixed-load pallets. Palletizing devices are essential for increasing productivity, reducing manual labor, and optimizing material handling procedures.

Cobots, now with bigger payload capacities (between 20kg and 50kg) and longer reaches, are the tools of choice when palletizing alongside workers or with mixed-load pallets. Palletizing devices are essential for increasing productivity, reducing manual labor, and optimizing material handling procedures.

Cobot cells seem to be the best setup for worker proximity and productivity, but mixed-load pallets are still an elusive challenge that nearly a dozen cobot vendors seem to be hotly pursuing, with varied levels of success.

It's the challenge that Doosan and its Otto Matic cobot claim to have conquered. Adding a 3D vision system, Dart Suite software, and machine learning (ML) seems to have done the trick. In addition to palletizing algorithms, Otto Matic gets trained on images of every product shape and size that it will ever encounter on the job, therefore, says Doosan, their tech allows the system to recognize and classify mixed and new object types, making it a more flexible system. Otto Matic, therefore, has no difficulty in loading or unloading mixed-load pallets.

With the use of sophisticated sensors, and programming, cobot cells can arrange products on pallets in a methodical manner, streamlining logistical processes and enabling the smooth flow of goods through warehouses, factories, and distribution centers.

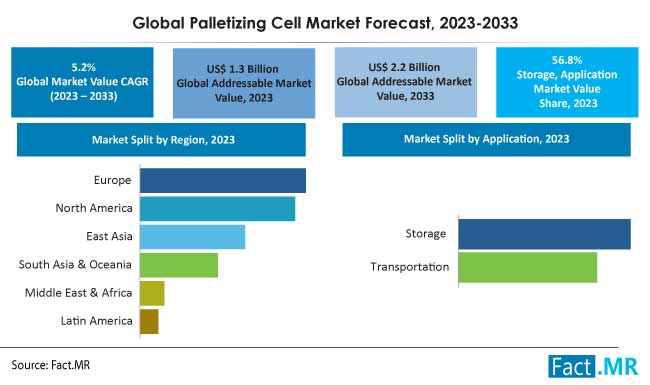

PALLETIZING MACHINE MARKET size was valued at $1.3 billion in 2023 and is expected to reach $2.2 billion by the end of 2030 with a CAGR of 4.4% during the Forecast Period 2024-2030.

ABB Robotics future-readies itself…twice!

Since the days of former CEO Ulrich Spiesshofer (2013-2019), Swiss-Swedish ABB has made it a point of being future-ready in all aspects of robotics as well as that technology’s future directions. Twice recently, ABB has demonstrated its chops at being future-ready.

FIRST: ABB’s mobile robotics trifecta is a perfect example. ABB, seeing the fast-approaching future of mobile logistics, e-commerce, and AMRs, acquired (2018) Belgian robotics automation provider, Intrion, to gain “domain expertise in fast-growing logistics automation market.” Then, in 2021, bought Spanish-based ASTI mobile robot maker, one of the EU’s best-known AMR developers. And now (five days ago), acquired Swiss startup Sevensense for its “eyes and brains” expertise in AMR navigation.

FIRST: ABB’s mobile robotics trifecta is a perfect example. ABB, seeing the fast-approaching future of mobile logistics, e-commerce, and AMRs, acquired (2018) Belgian robotics automation provider, Intrion, to gain “domain expertise in fast-growing logistics automation market.” Then, in 2021, bought Spanish-based ASTI mobile robot maker, one of the EU’s best-known AMR developers. And now (five days ago), acquired Swiss startup Sevensense for its “eyes and brains” expertise in AMR navigation.

So what do you think now dominates ABB’s website? How about a hero-image video clip of ABB’s AMRs (courtesy of ASTI) sporting eyes and sensors (courtesy of Sevensense) cruising through a warehouse? It feels like ABB has been a logistics leader since forever!

SECONDLY: ABB and Porsche Consulting will take on building homes in a factory. Another first for ABB! According to Business Insider (14 January 2024): “modular housing…is littered with companies that have gone bust.” Yet, the need for single-family housing both in the U.S. and EU (especially Germany) is critical (see video).

“Eberhard Weiblen, Chairman of the Executive Board at Porsche Consulting, stressed the significance of addressing the challenges the construction industry faces. He emphasized the potential for highly automated factories to produce superior, cost-effective housing. By merging ABB's cutting-edge robotic solutions with Porsche Consulting's expertise in state-of-the-art factory planning and management, the goal is to revamp the construction industry.”

In the near future, there may very well be families receiving packages shipped via ABB logistics to homes built by ABB’s robots.

Homes stick-built in a factory

Even small entrepreneurs can build homes in a factory using robots. Meet North Carolina-based BotBuilt.

Even small entrepreneurs can build homes in a factory using robots. Meet North Carolina-based BotBuilt.

BotBuilt is the brainchild of Brent Wadas, Colin Devine and robotics engineer Barrett Ames. BotBuilt aims to create a robotic system that can “take in a building plan, translate that plan into a series of machine commands and send those commands to its system.

”The company doesn’t build homes in its factory from scratch, rather it focuses on just constructing the framing. BotBuilt’s robots piece together panels for walls, floor trusses and roof trusses, which are the major framing components of homes (see video).

Ames says that his system costs about $1 per hour to run, and “can be reprogrammed to build “entirely” different frame designs for homes relatively quickly.” And affordably!

Leave a comment